IntoBusiness

your deep tech spinout practitioners

We are spinout practitioners

WHO WE ARE

Experienced deep tech founders

Passionate about helping great science have the opportunity it deserves in the market

Trusted by a large network of senior industry contacts and early stage investors

Experience in US, Europe, UK, globally

We will roll up our sleeves

WHAT WE WILL DO

Lead your sales effort, and later business planning and fundraising

Build a multi-year partnership with great academic founders

Behave as entrepreneurial co-founders

Be your executive chair when roles must be formalised (e.g. for fundraising)

Involve proven partners (accounting, recruitment, legal, etc.) when needed

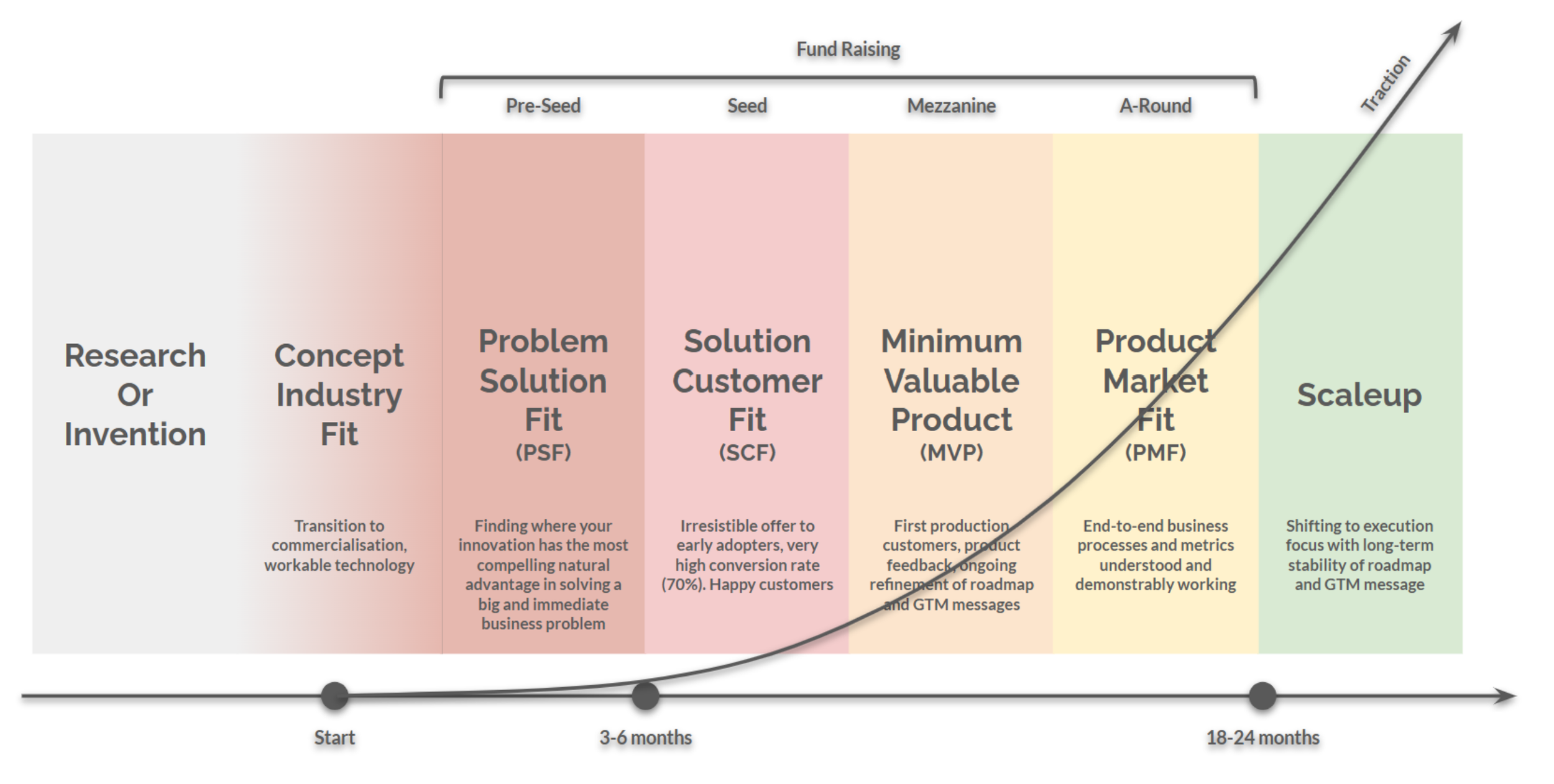

THE DEEP TECH JOURNEY

Our approach is strategic: building towards investment

Commercial orders bring in unambiguous clarity and focus to startup execution

Orders will align startup teams, and excite and engage customers and investors

Orders are critical success factors for:

Minimising time to minimum viable product, and product market fit, and cash neutral

Maximising valuation and balance sheet strength, and hence the probability of long term success

Teo Garcia Millan, CEO, CDotBio

“Few people have contributed as much value to our venture as IntoBusiness did in helping us achieve real commercial traction”

Andrea Martelloni, CEO, HITar

"As academic founders, we're told that we need to be great at business, but we're not told how to be great at business... that is what IntoBusiness brings"

How the deep tech journey works

THE DEEP TECH JOURNEY

1 - ASSESSMENT

Confirms the spinout resources, solution and IP protection are sufficient for I2B commercialisation

2 - WORKSHOP

I2B works with the founding team to develop market facing sales messaging

Phil Clare, CEO, Queen Mary Innovation

“IntoBusiness tackles the sales challenge directly - wins deals and accelerates commercialisation”

3 - PROBLEM SOLUTION FIT

I2B navigates the market in order to find and win early adopter revenue

4 - SOLUTION CUSTOMER FIT

Deliver to, and delight, early adopters, build business plan, pre-brief investors

Prof. Joe Briscoe, CEO, AeroSolar

“IntoBusiness nailed our value proposition, opened customer doors, and AeroSolar took off”

Continued early adopter engagement brings clarity and reduced risk for investors, maximising valuation and money raised

5 - INVESTMENT

Problem Solution Fit only ends when an order is signed

PSF PROCESS

Over time, commercial validation (sales) for startups has moved from the product-market fit stage, to the minimum viable product phase, and now to the very beginning of the startup journey

Commercial orders are the ultimate validation —or, absent them, a reality check—for market need, and problem-solution fit is increasingly seen as that initial validation process

PSF precedes all startup product development, go-to-market execution, and investor relations

PSF is a specialised startup sales motion that ends only when one or more purchase orders have been obtained

The goal of PSF is to identify and align the largest and most pervasive business problem with the most advantageous solution the startup can provide, and to verify this alignment with commercial agreements

Contact Us

Interested in learning more?

For an initial discussion on your spinout journey, reach out directly: